Managing money used to be complicated, but now finance apps make budgeting, saving, and even investing much easier. Whether you’re a student, professional, or entrepreneur, these apps help you stay in control of your finances. Here are the top 5 finance apps everyone should try.

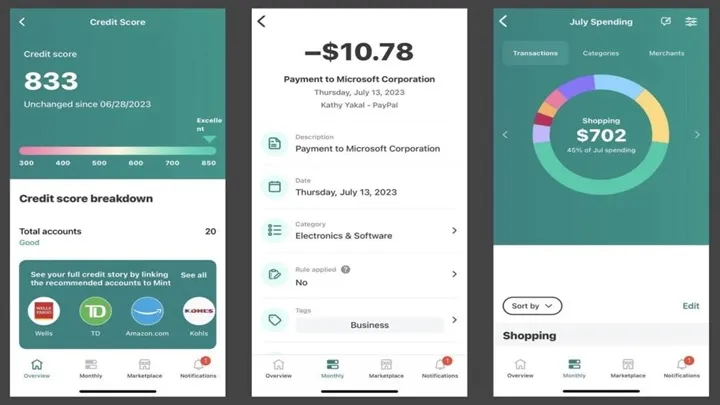

1. Mint – All-in-One Budget Tracker

Mint is one of the most popular apps for personal finance.

- Tracks expenses automatically.

- Creates budgets based on your spending.

- Provides bill reminders and credit score monitoring.

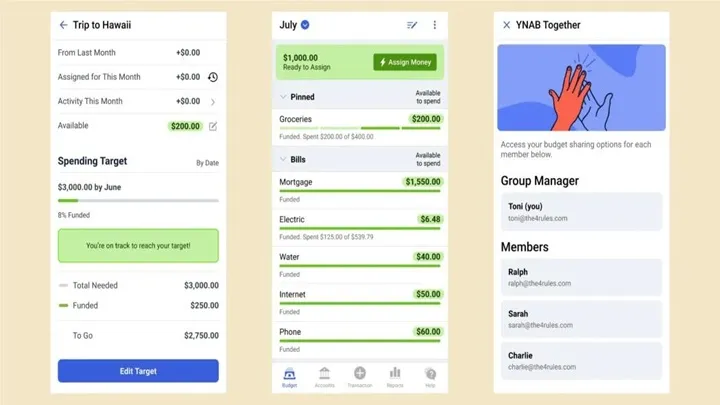

2. YNAB (You Need A Budget) – Master Your Budget

YNAB teaches you to take control of every dollar.

- Zero-based budgeting system.

- Goal-setting features for savings and debt payoff.

- Great for disciplined money management.

3. PayPal – Easy and Secure Payments

PayPal is trusted worldwide for online transactions.

- Send and receive money instantly.

- Safe for shopping and subscriptions.

- Works across countries and currencies.

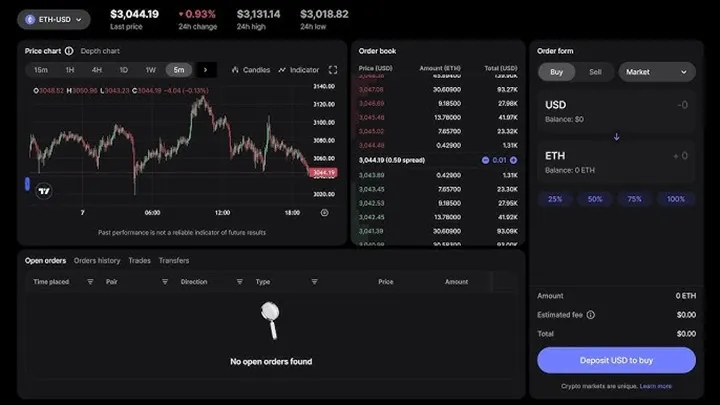

4. Robinhood – Investing Made Simple

Robinhood makes investing accessible for beginners.

- Commission-free stock and crypto trading.

- User-friendly interface.

- Educational resources for new investors.

5. Revolut – Banking for the Modern Era

Revolut is a powerful finance app with global features.

- Multi-currency accounts and currency exchange.

- Virtual cards for secure online shopping.

- Budget tracking and crypto access.

Why Finance Apps Matter

Finance apps empower you to manage money smarter, save more, and invest wisely. Whether you want to budget daily expenses or grow wealth long-term, these tools bring financial control to your fingertips.